Bill authorizes OPA to audit nonprofits who get GovGuam funding | News

900 out of more than 1,500 local organizations registered with the Guam Department of Revenue and Taxation in 2023 had their nonprofit designations revoked because of a failure to file a required annual financial report, said Public Auditor Benjamin Cruz.

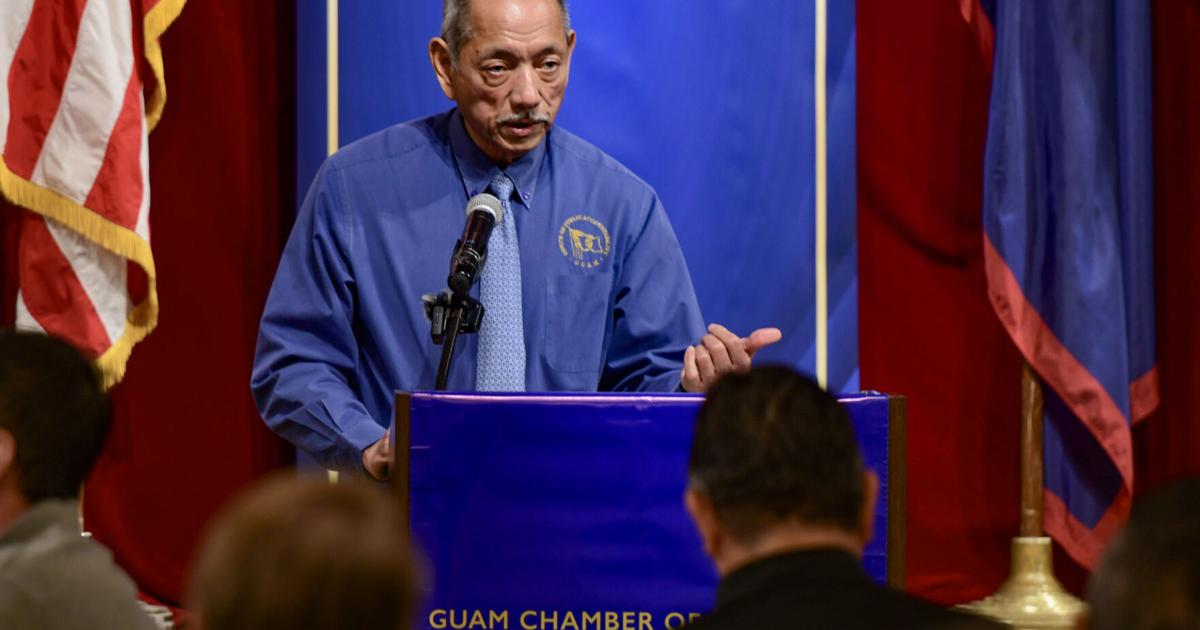

Cruz shared the information during a public hearing Thursday on Bill 364-37 by Sen. Frank Blas, Jr. which would give the Office of Public Accountability the authority and discretion to conduct audits on all transactions and accounts of nonprofit organizations and nongovernment organizations that receive funding from government of Guam departments or agencies.

Blas said current statute allows for the review of the financial status of NPO’s and NGO’s, but the law does not specifically authorize the OPA to conduct the audits.

“I assure you I have no intention of auditing every NGO or NPO, I just want the explicit authority to conduct an audit if we believe that it is necessary,” Cruz said.

The public auditor said that he was surprised to learn when watching recent legislative hearings on the fiscal 2025 supplemental budget bill “that there were NGOs and NPOs that have been receiving more money annually from the general fund than some of the smaller government agencies.”

Cruz also pointed out that in the past, one way to maintain public accountability for NPOs and NGOs was to require that they publish an annual financial statement in the local newspaper.

However, Cruz said it was the current 37th Guam legislature that repealed the law.

Bill 364-37 also establishes a $200,000 threshold at which the organizations may be audited. Blas said it could be a cumulative total of $200,000 or more, or a single appropriation of that amount.

Cruz said the current threshold for audits of nonprofits and nongovernmental organizations that receive federal funding is $750,000, but he said it will be raised to $1,000,000 next fiscal year.